do you pay taxes on inheritance in colorado

Inheritance taxes are taxes that apply directly to any property you receive as an inheritance. They may have related taxes to pay for example if.

Colorado Inheritance Laws What You Should Know Smartasset

First estate taxes are only paid by the estate.

. Colorado Inheritance Tax and Gift Tax. The first rule is simple. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

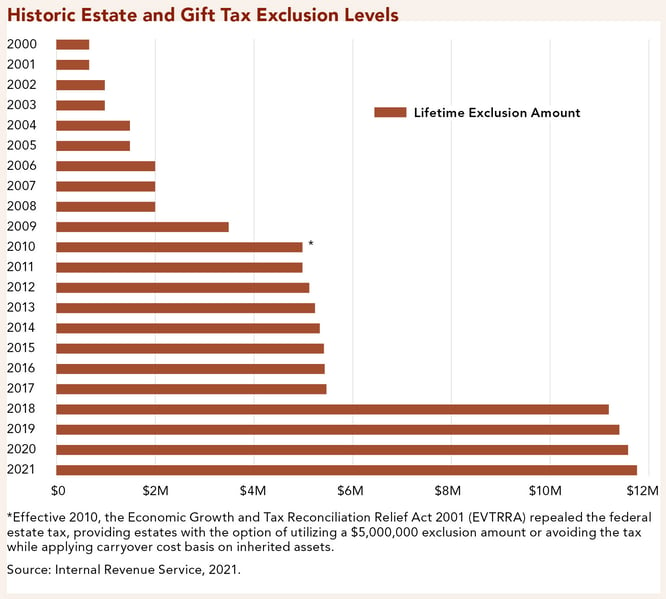

How much tax do you pay on inheritance. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

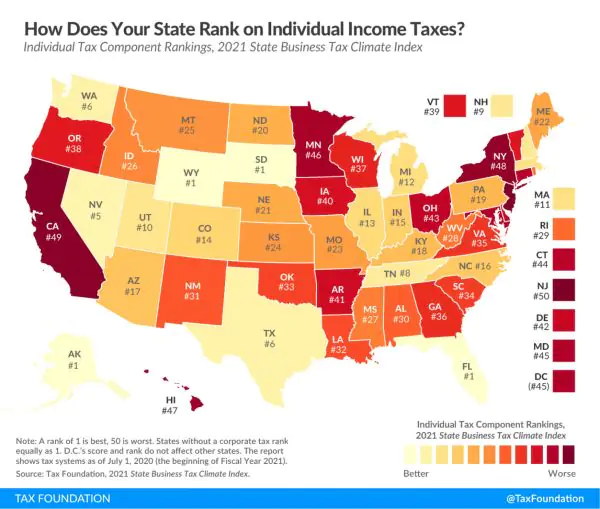

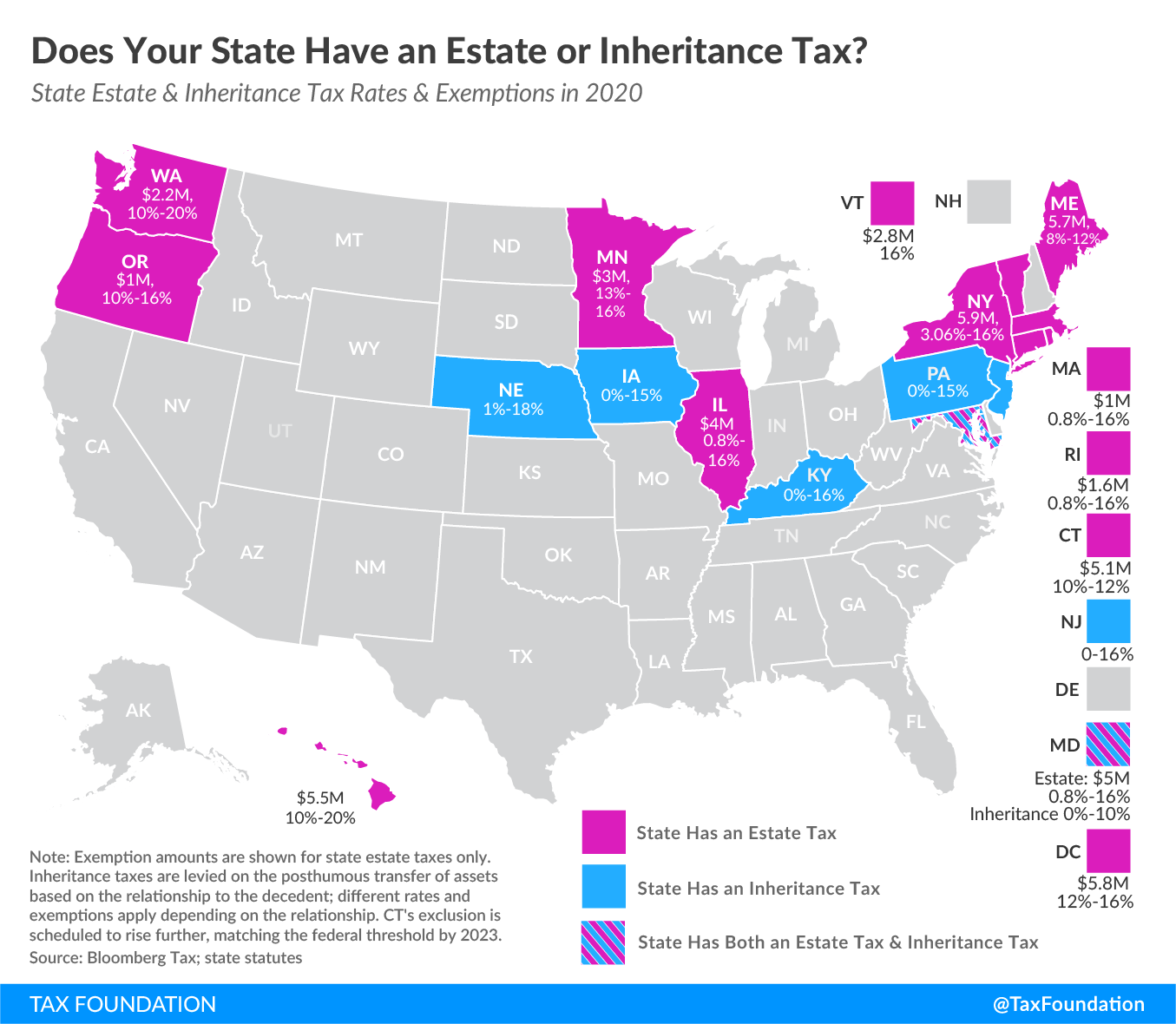

Twelve states as well as the District of Columbia collect estate taxes. So if you are about to inherit property from. These values may also be impacted by gifts that you make during your lifetime.

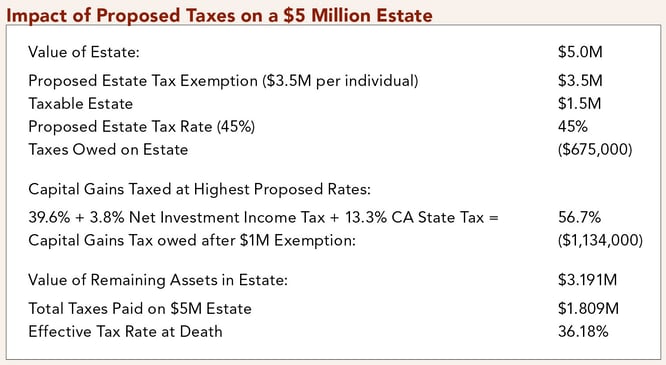

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. Individuals can exempt up to 117 million. There are exemptions before the 40.

What taxes do I pay on an inheritance. Inheritance taxes are different. After you die someone will become responsible for taking over your estate and determining whether it owes any estate taxes.

However a federal estate tax applies to estates larger than 117 million for 2021 and 1206 million for 2022. There is no federal inheritance tax but there is a federal estate tax. Inheritance tax is a tax paid by a beneficiary after receiving inheritance.

Federal Estate Tax Exemptions For 2022. When you pass away and you leave an inheritance there will an inheritance tax due. Do you have to pay taxes on 5000 inheritance.

04 aug 2021 qc 66054. Inheritance tax and inheritance tax rates are often misunderstood. The rate depends on your relationship with the person inheriting the mone.

Again Colorado is not one of the states. There is no federal inheritance taxthat is a tax on the sum of assets an individual receives from a deceased person. The following are the federal estate tax exemptions for 2022.

Colorado Form 105 Colorado Fiduciary Income Tax Return is the Colorado form for estate income taxes. This means that if your inheritance property is worth less than that you wont owe estate taxes on the federal level. As of 2019 the federal tax exemption on estate taxes is 114 million.

This really depends on the individual circumstances. Thats because federal law doesnt charge any inheritance. Although there is no federal tax on it inheritance is taxable in 6 states within the US.

Understand the different types of trusts and what that means for your investments. If you receive property in an inheritance you wont owe any federal tax. Our free Colorado paycheck calculator can help figure out what your take home pay in the Centennial State will be.

However if you receive an inheritance of real property and that real estate is located in a different state you should. Spouses are exempt from inheritance taxation while children can be exempt or pay a minimal amount. How much tax do you pay on inheritance.

In some states a person who receives an inheritance might. The 2017 tax reform law raised the federal estate tax exemption considerably. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance.

If it does its up to that person to pay those taxes not the inheritors. It happens only if they inherit an estate from a state that still levies local inheritance taxes that apply to the out-of-state heirs as well. There is no federal inheritance tax but there are a handful of states that impose state level inheritance taxes.

In other words when an estate is passed on the federal government taxes the transfer. You are welcome to call 720-493-4804 and ask for Dave. The tax in these states ranges from 0 to 18.

If the inheritance tax rate is 10 and you inherit. How does inheritance tax work for Colorado residents. There is no federal inheritance tax.

How much tax do you pay on inheritance. The beneficiary who receives the inheritance has to pay the tax. Yet some estates may have to pay a federal estate tax.

Married couples can exempt up to 234 million. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. The statewide sales tax in Colorado is just 29 but with local sales taxes.

However some estates might still be subject to federal estate taxes so it is important to understand how estate taxes work and whether they might apply to your estate. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Technically there is only one case where a Colorado resident would have to pay an inheritance tax.

Before that law was enacted the exemption was 549 million per person for decedents who died in 2017. Property taxes in Colorado are among the lowest in the country with an average effective rate of just 040. The annual gift exclusion is 15000.

The federal government doesnt charge inheritance tax which means you dont pay federal taxes on any money you inherit. There is no inheritance tax or estate tax in colorado. In Colorado the median property tax rate is 494 per 100000 of assessed home value.

There is also no Colorado inheritance tax or gift tax imposed under state law. Federal legislative changes reduced the state death. A state inheritance tax was enacted in Colorado in 1927.

The tax is assessed only on the portion of an estate that exceeds those. However if you receive an inheritance of real property and that real estate is located in a. Colorado Form 105 Colorado Fiduciary Income Tax Return is the Colorado form for estate income taxes.

Thats an increase from last year.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Got A Will Here Are 11 More End Of Life Documents You May Need

Here S Which States Collect Zero Estate Or Inheritance Taxes

Colorado State Taxes Everything You Need To Know Gobankingrates

We All Need Plans To Minimize State And Federal Estate Taxes And These Plans Are Best Structured By A Profession Estate Tax Estate Planning Financial Services

Creating A Comprehensive Estate Plan Requires You To Make Some Very Tough Decisions Estate Planning Estate Planning Checklist Funeral Planning Checklist

A New Era In Death And Estate Taxes

Will I Owe Taxes On My Inheritance

A New Era In Death And Estate Taxes

Do I Pay Taxes On Inheritance Of Savings Account

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Earned Income Tax Credit Now Available To Seniors Without Dependents

Vintage Ted Degrazia Angel Roadrunner Wall Hanging Etsy Art Painting Artwork

Don T Die In Nebraska How The County Inheritance Tax Works

It S Weekend Yaay Time To Take Stock And Be Thankful For The Past Week Have A Lovely One Accounting And Finance Academy The Past

What To Do And Not Do With An Inheritance

Where S My State Refund Track Your Refund In Every State

National Safety Month Tips For Keeping Aging Adults Safe In Their Ho National Safety Elderly Care Fall Prevention