arkansas estate tax return

Check your refund status at. The gift tax return is due on April 15th following the year in which the gift is made.

Is There An Inheritance Tax In Arkansas

Be sure to pay before then to avoid late penalties.

. AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc. This tax is item 5b on the Arkansas Estate Tax Return Form. Nonresident beneficiaries who have distributions from an arkansas estate or trust must file an arkansas individual income tax return ar1000nr that reflects the total income received from an arkansas source regardless of the amount of.

AR1000-OD Organ Donor Donation. Arkansas Estate Tax Return andor Pay Estate Tax AR321E File this request in triplicate on or before the due date of the return. Arkansas doesnt have an estate tax but the federal estate tax may still apply.

The Arkansas Sales and Use Tax Section does not send blank Arkansas Excise Tax Return ET-1 forms to taxpayers. A 1 Returns by Executor. Managed by your County Collector.

IDENTIFICATION Date of Death Decedents SSN Estate Tax Return Due Date Decedents First Name and Middle Initial Decedents Last Name. AR1002F Fiduciary Income Tax Return. The vehicle assessment that you submit each year is used to calculate your personal property taxes in the county in which you reside.

In Arkansas small estates are valued at 100000 or less and bypass probate proceedings entirely. One 1 copy of the approved request must be attached to the return when filed. Sales and Use Tax Forms.

Arkansas - Department of Finance and Administration. Generally the estate tax return is due nine months after the date of death. This page contains basic information to help you.

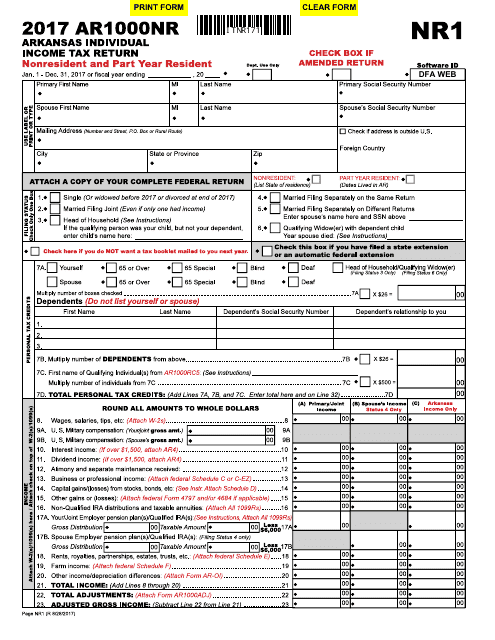

Effective tax year 2011 the completed AR8453-OL along with the AR1000F or AR1000NR any W-2s or schedules are to be kept in your files. AR1000NR Part Year or Non-Resident Individual Income Tax Return. The amount exempted from federal estate taxes is 1119 million for 2019 but if you do not plan properly then your family or other heirs could end up getting far less of your assets than you.

AR1000TC Schedule of Tax Credits and Business Incentive Credits. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related. Deceased Taxpayers Filing the Estate Income Tax Return Form 1041.

AR1002NR Non-Resident Fiduciary Income Tax Return. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. This is a quick summary of Arkansas probate and estate tax laws.

Arkansas Probate and Estate Tax Laws. Pay-by-Phone IVR 1-866-257-2055. Arkansas does not have any estate tax or inheritance tax which is good news for heirs and beneficiaries in arkansas.

For faster service file your Sales and Use Tax Returns online at httpsataparkansasgov. Online payments are available for most counties. Preparing and distributing tax forms and instructions to individuals and businesses necessary to complete Individual Partnership.

These additional measures may result in tax refunds not being issued as quickly as in past years. In the case of the estate of a resident or a nonresident who dies having real property andor tangible personal property located in a state other than Arkansas the Arkansas tax due shall be a percentage of the Federal Credit Allowable for State Death Taxes in the same proportion which. Identity Theft has been a growing problem nationally and the Department is taking additional measures to ensure tax refunds are issued to the correct individuals.

Contact 501-682-7104 to request ET-1 forms and the forms will be mailed to your business in two to three weeks. The following table outlines probate and estate tax laws in Arkansas. The federal estate tax exemption is 1170 million in 2021 increasing to 1206 Married couples can transfer their exemption to each other.

If you choose to electronically file your State of Arkansas tax return by using one of the online web providers you are required to complete the form AR8453-OL. Each year that you pay property taxes you are paying for the previous years assessment. The statewide property tax deadline is October 15.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. The Individual Income Tax Section is responsible for technical assistance to the tax community in the interpretation of Individual Partnership Fiduciary and Limited Liability Company tax codes and regulations. Arkansas does not have any estate tax or inheritance tax which is good news for heirs and beneficiaries in arkansas.

The process however can take longer for contested estates. PO Box 8110 Little Rock AR 72203. Taxes in Arkansas Personal Property Tax and Real Estate Taxes.

AR1000F Full Year Resident Individual Income Tax Return. One on the transfer of assets from the decedent to their beneficiaries and heirs the estate tax and another on income generated by assets of the decedents estate the income tax. Arkansas doesnt have an.

AR1002-TC Fiduciary Schedule of Tax Credits and Business Incentive Credits. There are two kinds of taxes owed by an estate. AR4FID Fiduciary Interest and Dividends.

Provides up to a 375 tax credit on property that is the owners primary place of residence. In all cases in which the gross estate at the death of a citizen or resident of the United States exceeds one million dollars 1000000 and a portion of the property comprising the gross estate is located in Arkansas then the executor shall make a return with respect to the estate tax imposed by this chapter. AR1000RC5 Individuals With Developmental Disabilites Certificate.

Income Tax Administration IndividualIncomedfaarkansasgov Ledbetter Building 1816 W 7th St Rm 2220 Little Rock AR 72201 Mailing Address. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan.

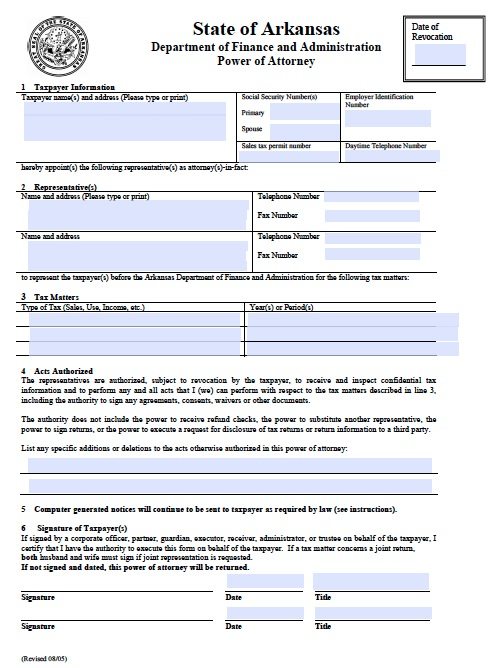

Free Tax Power Of Attorney Arkansas Form Fillable Pdf

Arkansas Inheritance Laws What You Should Know

Where S My Refund Arkansas H R Block

Where S My Arkansas State Tax Refund Taxact Blog

2020 2022 Form Ar Dfa Ar1000f Fill Online Printable Fillable Blank Pdffiller

Arkansas State Tax Return Fill Online Printable Fillable Blank Pdffiller

Arkansas Tax Amendment Instructions And Forms Prepare Online

Filing An Arkansas State Tax Return Things To Know Credit Karma Tax

Arkansas Property Tax Calculator Smartasset

Trends Analysis Arkansas Business News Arkansasbusiness Com

Arkansas State 2022 Taxes Forbes Advisor

Free Arkansas Eviction Notice Forms Process And Laws Pdf Word Eforms Free Fillable Forms Eviction Notice Notes Template Rental Agreement Templates

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

The Ultimate Guide To Arkansas Real Estate Taxes

Learn More About Arkansas Property Taxes H R Block

475 000 Homes In Massachusetts The District Of Columbia And Arkansas In 2022 Fenced In Yard Blue Accent Walls House Prices

Form Ar1000nr Download Fillable Pdf Or Fill Online Arkansas Individual Income Tax Return Nonresident And Part Year Resident 2017 Arkansas Templateroller

Estate Lawyer California Estate Services And Litigation Attorneys Keystone Law Group Medical Malpractice Lawyers Criminal Defense Attorney Litigation Lawyer